Bitwise slated to launch milestone US solana ETF Tuesday

Canary Capital ETFs that hold HBAR and LTC are slated to debut on the Nasdaq tomorrow

Alexander Zulkarnain/Shuttestock and Adobe modified by Blockworks

Bitwise’s proposed solana ETF is set to go live on the NYSE Arca Tuesday — marking the latest milestone in a pivotal year for crypto.

The firm revealed the upcoming launch Monday evening, calling its Solana Staking ETF (BSOL) the “first US ETP to have 100% direct exposure to spot SOL.” Staking of the product’s SOL will be powered by Helius, Bitwise said.

Source: X

Source: X

The announcement came just hours after Bitwise wrote “Big week incoming” in an X post, fueling speculation of ETF developments. A NYSE letter, dated Monday, noted the exchange “certifies its approval for listing and registration” of the product.

Proposed Canary Capital ETFs that hold hedera (HBAR) and litecoin (LTC) also “went effective” Monday, Canary CEO Steven McClurg told me in an email. The plan is for those to begin trading on the Nasdaq tomorrow morning, he added.

The imminent product debuts follows the launch of US bitcoin and ether ETFs in January 2024 and July 2024, respectively.

Issuers had been working with the SEC’s Division of Corporation Finance in recent months to finalize S-1 registration statements tied to solana product proposals. Though progress was slowed amid the ongoing US government shutdown, discussions with the regulator did not halt completely.

The greenlight from the SEC to launch these ETFs comes after the agency last month finalized generic listings standards for exchange-traded products that hold spot commodities.

Read more: Crypto ETF swell approaching after Grayscale’s latest launch

The standards essentially streamline an ETF’s approval so long as the underlying holdings meet certain requirements — like having futures trading on CFTC-regulated venues for six-plus months.

Bitwise CIO Matt Hougan told Blockworks last month that new crypto ETPs could launch by Halloween.

Hougan wrote in a September memo that Solana’s promoters argue it’s “the only blockchain fast enough to support the tokenization of major assets at a global scale.”

Other issuers with solana ETF proposals include Grayscale, 21Shares, Canary Capital, Franklin Templeton, VanEck, Fidelity and CoinShares.

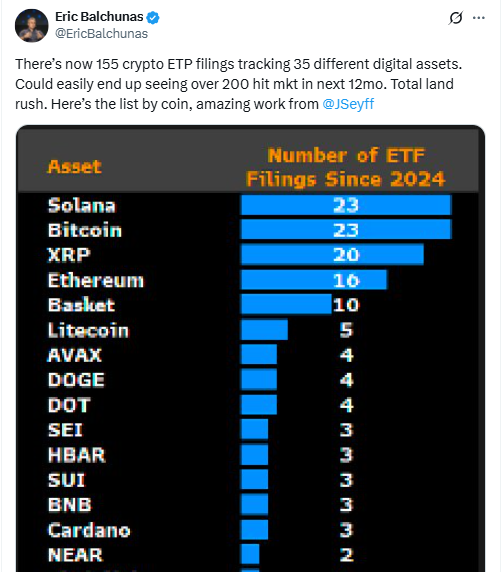

A number of asset managers, including Bitwise, are also seeking to launch ETFs holding other crypto tokens.

Source: X

Source: X

With the generic listing standards in place, industry watchers expect many more single-asset crypto ETFs — including products that hold XRP — to hit US exchanges by the end of the year.

This is a developing story.

This article was generated with the assistance of AI and reviewed by editor Michael McSweeney before publication.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.