Capitol Gains: Shutdown blues slow crypto work

Experts agree that the shutdown will delay new crypto ETF approvals, but lawmakers seem keen to move ahead with legislative work

Andrea Izzotti/Shutterstock and Adobe modified by Blockworks

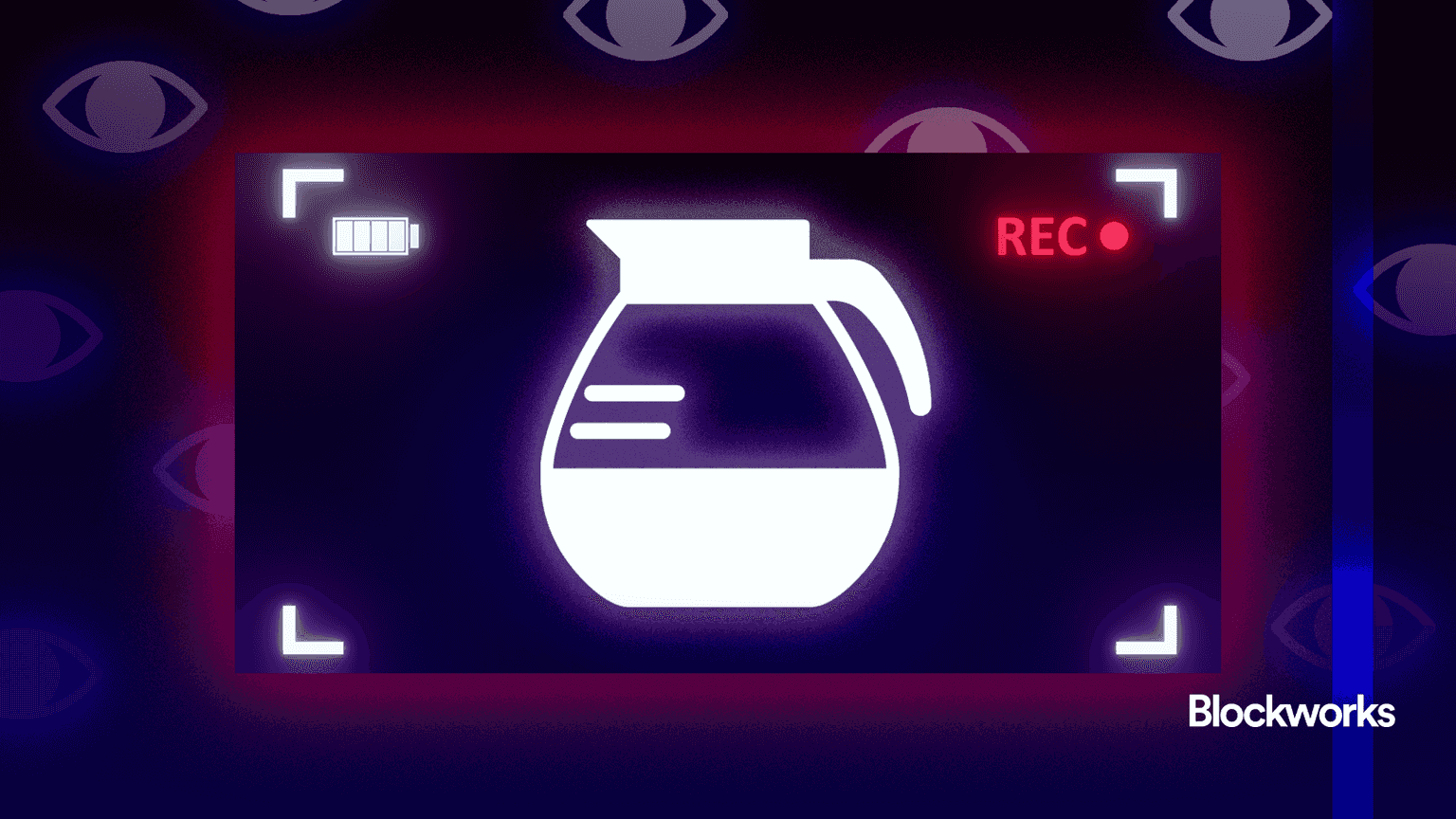

As the US government shutdown enters its second day, the crypto industry is left wondering how the closure will impact pending regulatory matters.

Currently in limbo: the crypto market structure bill, the status of GENIUS Act policies, and the timeline for approving certain spot crypto ETFs.

Spot crypto ETFs

Perhaps the most direct impact the government shutdown is expected to have on the crypto industry is that new spot crypto ETFs will be delayed.

The Securities and Exchange Commission said that during the shutdown, staff will not review or approve registration statements or issue notices of effectiveness.

An “extremely limited number” of SEC staff will be monitoring emergency email addresses and phone lines for each commission division, the guidance added. An “emergency” would be anything that immediately threatens market stability, personal safety or property protection.

One crypto ETF issuer told Blockworks that prior to the shutdown, they were feeling confident about listing on Monday, Oct. 6.

But now things are up in the air.

Crypto market structure bill

Despite the shutdown, members of the Senate Banking Committee plan to work on the market structure bill that is due for a markup, according to a person familiar with the matter.

Lawmakers originally wanted to hold a markup hearing for the Responsible Financial Innovation Act of 2025 at the end of September, Blockworks previously reported, but the failure to pass an appropriations bill delayed this timeline.

Senate Banking Committee Republicans in September finalized the bill draft, expanding upon the House’s CLARITY Act, which passed in July.

The industry is still waiting for the Senate Agriculture Committee — which oversees the Commodity Futures Trading Commission — to release its version of a market structure bill.

A person familiar with the matter told Blockworks ahead of the shutdown that the Agriculture Committee’s draft was “close” but market structure legislation is proving to be more complicated than stablecoin rules.

Should the Senate Banking Committee move forward with a market structure bill markup mid-shutdown, they wouldn’t be the only Committee proceeding with crypto business as scheduled.

On Wednesday, in the first hours of the shutdown, the Senate Finance Committee held a hearing on crypto tax policy.

In his opening remarks, ranking member Sen. Ron Wyden said that while cryptocurrency taxation is an important issue Senators need to “get right,” holding the hearing yesterday showed a “warped sense of priorities.”

Senate Finance Committee Chairman Mike Crapo said the budget debate will continue, but updating the tax code should be a primary concern for lawmakers.

“Without clear tax rules, taxpayers are left with many unanswered questions and individuals, businesses and our country’s finances bear the burden,” Crapo said. “Lingering tax uncertainty also makes the U.S. a less attractive place to do business and invest, and hurts tax compliance.

GENIUS Act

Stablecoin legislation, as it turns out, may not be as straightforward as lawmakers originally believed.

The GENIUS Act became law in July, but that was only step one. The bill lays out a general framework, but it delegates responsibilities to federal and state regulators, who are now tasked with writing and issuing new rules. These include licensing requirements, enforcement processes, AML procedures, etc.

It’s going to take a long time, and we knew that prior to the shutdown, but with agencies currently operating with skeleton crews, designing stablecoin policy is not a top priority.

Plus, the lobbying around stablecoin legislation didn’t stop when President Trump signed the GENIUS Act. Big banks and crypto companies — mostly exchanges — are still at odds over rules surrounding stablecoin yields, and both sides are prepared for an expensive fight, according to a person familiar.

The GENIUS Act stipulates that no stablecoin issuers can offer any yield or interest on holdings. It prohibits issues from offering yields directly, but does not block exchanges, or “affiliates,” from doing so.

Banks weren’t happy about this language, but the crypto industry, especially Coinbase, was.

Back in March, when GENIUS Act negotiations were underway, Coinbase CEO Brian Armstrong emphasized the need for allowing interest payments on stablecoins. “We can choose to level the playing field and ensure these laws pave a way for all regulated stablecoins to deliver interest directly to consumers, the same way a savings or checking account can,” Armstrong wrote in a post on X.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.